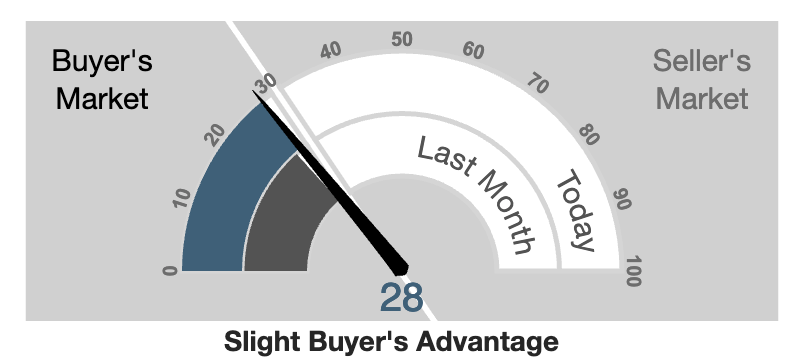

September Coastal Market Update: South Orange County

This week the median list price for Laguna Beach, CA is $4,997,000 with the market action index hovering around 28. This is about the same as last month's market action index of 28. Inventory has decreased to 178.

The market has shown some evidence of slowing recently. Both prices and inventory levels are relatively unchanged in recent weeks. Watch the Market Action Index for changes as it can be a leading indicator for price changes.

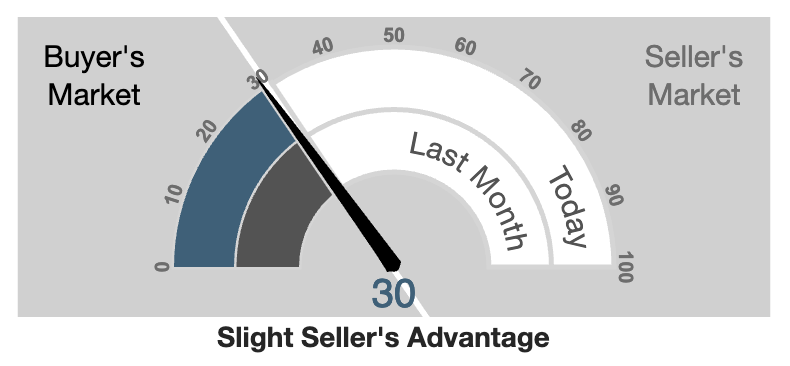

Newport Beach, CA Market Update

Median List Price: $5,995,000

Market Action Index (MAI): 30 – Slight Seller’s Advantage

Inventory: 176

This week the median list price for Newport Beach, CA is $5,995,000 with the market action index hovering around 30. This is about the same as last month's market action index of 30. Inventory has decreased to 176.

While the Market Action Index shows some strengthening in the last few weeks, prices have not seemed to move from their plateau. Should the upward trend in sales relative to inventory continue, expect prices to resume an upward climb in tandem with the MAI.

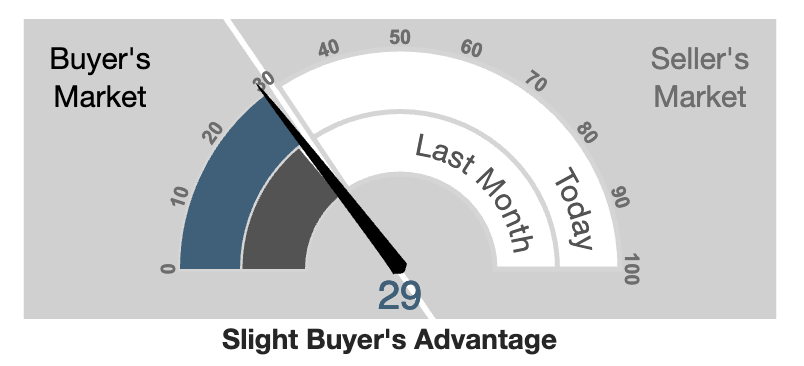

Corona Del Mar, CA Market Update

Median List Price: $

Market Action Index (MAI): 29 – Slight Buyers’s Advantage

Inventory: 54

This week the median list price for Corona Del Mar, CA is $7,995,000 with the market action index hovering around 29. This is an increase over last month's market action index of 28. Inventory has decreased to 52.

Home sales have begun exceeding new inventory. This is a Buyer’s market so prices are not yet moving higher as excess inventory is consumed. If the tightening continues and the market moves into the Seller’s zone, we may see upward pressure on pricing.

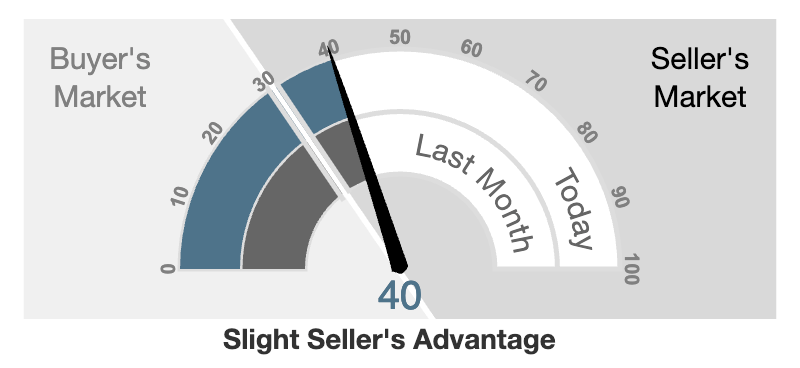

Laguna Niguel, CA Market Update

Median List Price: $1,999,899

Market Action Index (MAI): 40 – Slight Seller’s Advantage

Inventory: 87

This week the median list price for Laguna Niguel, CA is $1,999,899 with the market action index hovering around 40. This is about the same as last month's market action index of 40. Inventory has decreased to 87.

In the last few weeks the market has achieved a relative stasis point in terms of sales to inventory. However, inventory is sufficiently low to keep us in the Seller’s Market zone so watch changes in the MAI. If the market heats up, prices are likely to resume an upward climb.

Dana Point, CA Market Update

Median List Price: $4,750,000

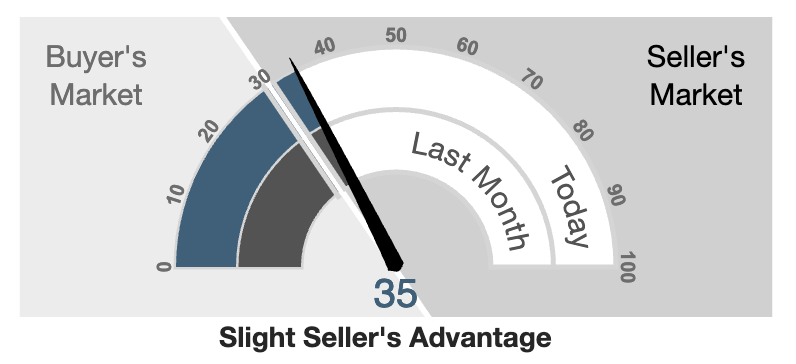

Market Action Index (MAI): 35 – Slight Seller’s Advantage

Inventory: 55

This week the median list price for Dana Point, CA is $4,750,000 with the market action index hovering around 35. This is about the same as last month's market action index of 35. Inventory has held steady at or around 55.

The market has started cooling and prices have recently plateaued. Since we’re in the Seller’s zone, watch for changes in MAI. If the MAI resumes its climb, prices will likely follow suit. If the MAI drops consistently or falls into the Buyer’s zone, watch for downward pressure on prices.

San Juan Capistrano, CA Market Update

Median List Price: $2,494,500

Market Action Index (MAI): 35 – Slight Seller’s Advantage

Inventory: 66

This week the median list price for San Juan Capistrano, CA is $2,494,500 with the market action index hovering around 35. This is less than last month's market action index of 36. Inventory has held steady at or around 66.

The market has been cooling over time and prices have recently flattened. Despite the consistent decrease in Market Action Index (MAI), we’re in a Seller’s Market (where significant demand leaves little inventory available). If the MAI begins to climb, prices will likely follow suit. If the MAI drops consistently or falls into the Buyer’s zone, watch for downward pressure on prices.

Categories

Recent Posts

GET MORE INFORMATION